Our following analysis takes a deep dive into the monetary landscapes of the Fortune 500 international firms listing, unraveling the intricacies of their profitability and disparities between U.S. and worldwide counterparts.

Within the fiscal 12 months ending March 31, 2023, the high 500 firms amassed a staggering $41 trillion in income, yielding a profound $2.9 trillion in earnings. The U.S. emerged as a revenue behemoth, with its 136 Fortune 500 firms contributing a large 38% to the worldwide revenue pool.

This examine meticulously examines sector-wise profitability, nation comparisons, and the highs and lows throughout the Fortune 500, providing a panoramic view of the world’s financial powerhouses.

Key Findings

- World Giants: Fortune 500 firms amassed a colossal $41 trillion in income, with $2.9 trillion in revenue.

- High World Revenue Makers: The highest 10 firms globally amassed $689.8B (24%) in revenue, with Saudi Aramco main at $159.1B.

- World Losses: The underside 10 firms worldwide incurred a collective lack of almost $126B.

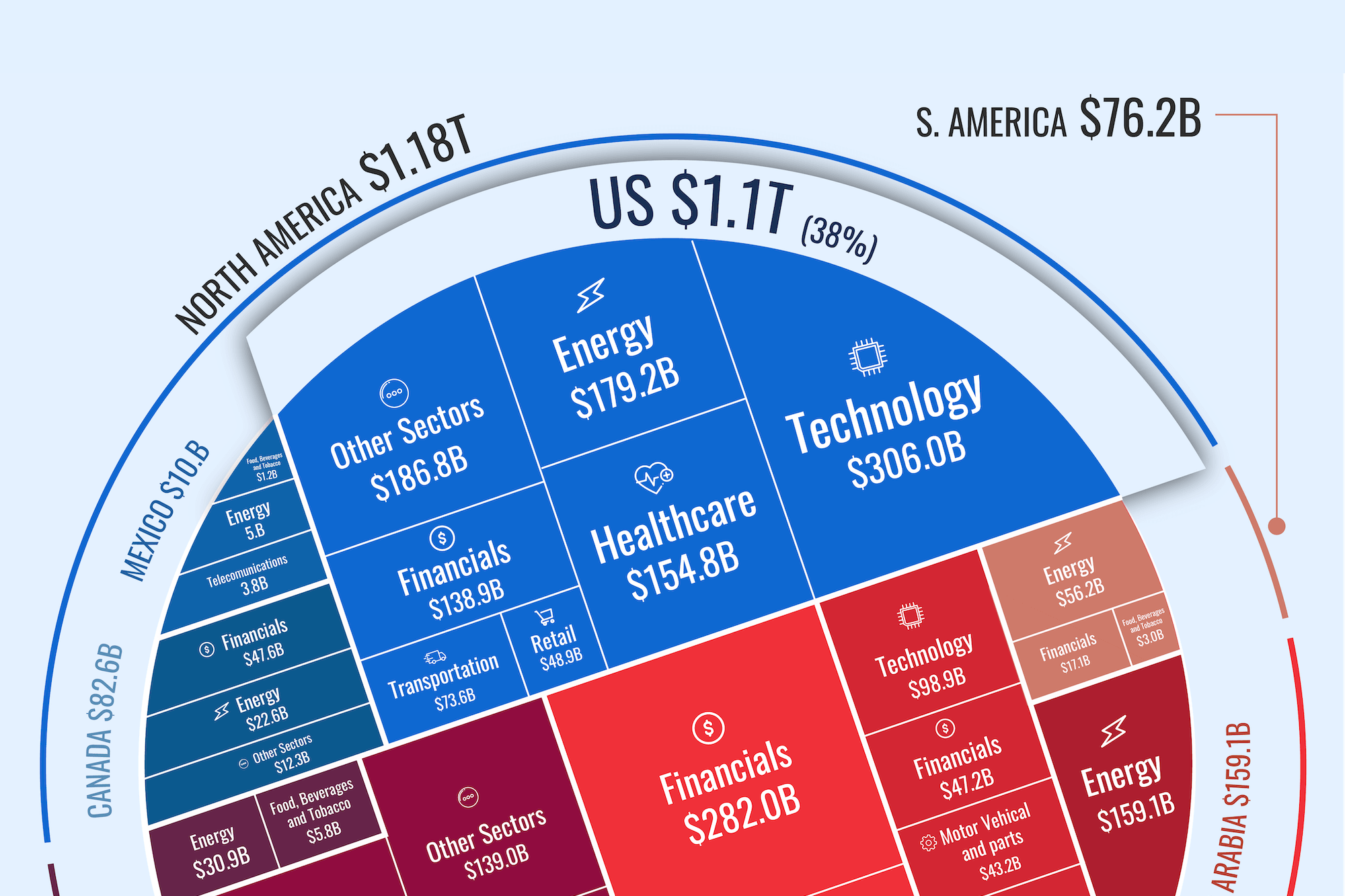

- U.S. Dominance: U.S. firms (136) secured a exceptional $1.1T revenue, overshadowing China’s $528B, regardless of comparable firm numbers.

- The U.S. and China collectively generate 56% of the worldwide 500 firms’ revenue.

- Sector Powerhouses: Know-how, Finance, and Power sectors claimed 63% of the $2.9 trillion international revenue.

- U.S. Sector Standouts: The Know-how sector within the U.S. emerged as essentially the most worthwhile, producing $306B, constituting 28% of the nation’s whole revenue.

- High U.S. Performers: The highest 10 U.S. firms contributed 46% of the $1.1 trillion whole revenue, led by Apple.

- Sectoral Disparities: Media, Wholesaler, and Retail sectors within the U.S. lagged behind with revenue margins of 0.76%, 1.53%, and a pair of.60%, respectively.

High 500 Most Worthwhile Firms: U.S. vs. the World [Infographic]

10 Most Worthwhile of the Largest Firms within the World, 2023

The elite league of the world’s 10 most worthwhile firms in 2023 showcases a powerhouse of monetary success. These business giants, representing the Power, Know-how, Transportation, and Monetary sectors, collectively amassed a jaw-dropping $689.8 billion in earnings, constituting 24% of the overall revenue from the analyzed Fortune 500 firms.

The common revenue per firm inside this elite group is a formidable $69 billion.

Notably, half of the highest 10 are U.S.-based firms, underlining the financial dominance of American companies on the worldwide stage.

Every of those firms showcases the varied monetary prowess throughout sectors in 2023. Saudi Aramco steals the highlight with an unparalleled revenue of $159.1 billion, accounting for a exceptional 5.49% of the worldwide 500 whole revenue — emphasizing the dominant function the power sector performs in producing substantial monetary beneficial properties.

The U.S. Postal Service surprises as the one consultant within the transportation sector, boasting a exceptional revenue of $56 billion (71.29%) with a income of $78.6 billion, outshining all of its friends with ease.

Within the expertise realm, Apple, Microsoft, and Alphabet safe high positions, collectively contributing $232.5 billion in revenue. Microsoft stands out with a formidable revenue margin of 36.69%, underscoring the profitability potential in software program and technological options.

Within the monetary realm, Industrial & Industrial Financial institution of China and China Development Financial institution secured their spots by contributing a mixed revenue of $107.7 billion.

The power sector, represented by Exxon Mobil and Shell, contributes considerably too, with each firms collectively accounting for $98 billion in revenue.

General, this high 10 ensemble underscores the worldwide influence of various industries, from power giants to expertise titans, that form the monetary panorama with substantial earnings.

10 Least Worthwhile of the Largest Firms within the World, 2023

The underside 10 firms in 2023, nonetheless, collectively confronted vital monetary challenges, accumulating a staggering mixed lack of virtually $126 billion through the analyzed fiscal 12 months.

Notably, business giants Berkshire Hathaway and Uniper, ranked 14th and sixteenth in Fortune’s official rating with big revenues of $302.1 billion and $288.3 billion, respectively, discovered themselves among the many least worthwhile.

The common loss per firm inside this group amounted to -$12.6 billion, reflecting the numerous monetary challenges these firms encountered.

The power sector, represented by Uniper, Korea Electrical Energy, Electricité de France, and CPC, dominates the listing, collectively contributing to a considerable $53.2 billion in losses.

In the meantime, expertise and telecommunications firms, resembling Uber Applied sciences, AT&T, Warner Bros. Discovery, and SoftBank Group, have additionally needed to grapple with substantial losses, emphasizing the various challenges confronted throughout various sectors.

The inclusion of well-known names like AT&T and Uber within the least worthwhile listing helps to focus on the wild unpredictability and volatility inherent in in the present day’s international enterprise panorama.

Most Worthwhile Sectors for the World’s Largest Firms, 2023

The highest 3 sectors — power, finance, and expertise — emerge as essentially the most worthwhile among the many world’s largest firms in 2023, collectively contributing to an enormous 63% of the overall international revenue, amounting to $1.8 trillion.

With a revenue share of 24.56%, the power sector takes the lead, bolstering $711.6 billion in revenue by 88 firms throughout the Fortune 500.

Finance follows carefully, with 101 firms and a 23.07% revenue share, showcasing it nonetheless holds appreciable monetary dominance.

Know-how, represented by 35 firms, secures a notable 15.54% revenue share, underlining its continued significance within the revenue panorama.

Healthcare, represented by 30 firms, holds a 7.51% revenue share with $217.6 billion in revenue and considerably contributes to the profitability of the world’s largest firms.

Transportation, with 22 firms, secures a notable 5.54% of whole revenue, amounting to $160.5 billion in revenue. The sector’s function in facilitating international motion is obvious in its substantial revenue share.

Motor Automobile and Elements, encompassing 34 firms, contribute a noteworthy 5.36% to the worldwide revenue, producing $155.4 billion. The automotive business’s influence remains to be substantial, albeit with a barely decrease revenue margin in comparison with different main sectors.

The remaining sectors, together with Meals, Drinks and Tobacco, Telecommunications, Retail, Supplies, Wholesaler, Industrial, Engineering and Development, Family Merchandise, Aerospace and Defence, Chemical compounds, Meals and Drug Shops, Attire, and Inns, Eating places, Leisure, collectively make precious contributions to the worldwide revenue panorama, showcasing the varied strengths and significance of every particular person sector.

This evaluation helps to focus on the varied strengths and contributions of varied sectors throughout the globe, with power, finance, and expertise main the cost in shaping the monetary panorama of the biggest international enterprises.

Rating Nations by Complete Company Revenue, 2023

Within the dynamic panorama of worldwide company giants, the United States and China emerge as titans, every housing a near-equal variety of firms on the Fortune 500 listing with revenues totaling $13 trillion and $11.2 trillion, respectively.

Regardless of this similarity, the U.S. outshines all nations, with its 136 firms producing a staggering $1.1 trillion in revenue, representing 37.56% of the overall international revenue. China follows carefully, with 135 firms contributing $528 billion, comprising just below half of the U.S.’s international revenue pool with 18.22%.

The mixed pressure of the U.S. and China stands out, collectively accounting for $1.6 trillion (56%) of the overall revenue, surpassing all different nations mixed, which contribute $1.3 trillion (44%) in whole.

Saudi Arabia secures the third place with a single firm producing $159.1 billion in revenue, making it 5.49% of the overall international revenue.

Continental Evaluation

Within the international panorama of company profitability, North America takes the highest spot because the foremost financial powerhouse, contributing a formidable $1.18 trillion in revenue and commanding a considerable 40.75% share of the worldwide revenue. The USA emerges as the main participant throughout the continent, underscoring its unparalleled financial affect.

Venturing throughout the pond into Europe, the continent collectively generates $629.9 billion in revenue, claiming a notable 21.74% share of the worldwide revenue. The UK and Germany take the lead amongst European nations, showcasing their financial energy and vital company contributions.

Throughout the expansive and various Asian continent, encompassing China, Japan, and Saudi Arabia, the mixed revenue quantities to $974 billion, representing a formidable 33.62% share of the worldwide revenue. China, Japan, and Saudi Arabia emerge as main contributors, collectively illustrating Asia’s substantial financial affect.

Brazil is the one South American nation. Their company entities contribute considerably to the worldwide revenue pool, producing $76.2 billion and holding a 2.63% share.

Australia, positioned within the Asia-Pacific area, makes a notable influence with $36.7 billion in revenue, constituting a modest 1.26% share of the worldwide revenue.

This continental evaluation supplies a complete and clear overview of company profitability, showcasing the main gamers and their contributions inside every area.

High 10 U.S. Firms with the Highest Revenue, 2023

Within the dynamic panorama of company profitability inside the US, the highest 10 firms among the many Fortune 500 elite emerge as extraordinarily formidable contributors.

These 10 firms, out of a complete of 136 U.S. firms, collectively generate a staggering $499.5 billion in revenue, comprising a formidable 46% of the overall earnings amassed by all 136 U.S. entities.

Apple leads the pack, commanding a lion’s share with $99.8 billion in revenue, constituting 9.17% of the general earnings amongst U.S. firms.

The composition of the highest 10 displays a various vary of sectors, with expertise taking the lead. Following Apple, Microsoft and Alphabet secured the second and third positions, contributing $72.7 billion and $60 billion in revenue, respectively.

The U.S. Postal Service, representing the transportation sector, stands out with a exceptional revenue of $56 billion.

Persevering with down the listing, power giants Exxon Mobil and Chevron contribute considerably, with earnings of $55.7 billion and $35.5 billion, respectively.

Monetary establishments JPMorgan Chase and Financial institution of America showcase their dominance, with earnings amounting to $37.7 billion and $27.5 billion, respectively.

Meta Platforms, a expertise big, rounds out the highest 10, contributing a formidable $23.2 billion in revenue.

This collective dominance underscores the numerous function performed by these choose few in steering the financial trajectory of the nation.

High 10 U.S. Firms with the Highest Loss, 2023

Within the realm of company challenges, the highest 10 U.S. firms with the best losses confronted a mixed setback of $66.9 billion.

Notable among the many highest losers are Amazon and Berkshire Hathaway, rating because the 4th and 14th largest international firms, with large revenues of $514 billion and $302.1 billion, respectively. Regardless of their outstanding positions, each firms incurred vital losses through the analyzed interval, with Amazon reporting a stunning lack of $2.7 billion, and Berkshire Hathaway dealing with a considerable lack of $22.8 billion.

Uber Applied sciences and Warner Bros. Discovery skilled essentially the most vital proportion losses, with 28.68% and 21.80%, respectively.

Intriguingly, 4 out of the highest 10 least worthwhile firms within the U.S. belong to the Financials sector—Berkshire Hathaway, State Farm Insurance coverage, Prudential Monetary, and Allstate.

These challenges illuminate the varied panorama of company efficiency, emphasizing the sectoral variations throughout the high firms experiencing losses.

Most Worthwhile Sectors for the High U.S. Firms, 2023

The expertise sector emerges because the powerhouse for the highest U.S. firms, contributing considerably to the nation’s whole revenue of $1.3 trillion.

With a exceptional $306 billion in revenue, the expertise sector instructions a considerable 28% share of the general revenue generated by all sectors. Impressively, the Know-how sector additionally showcases a strong revenue margin of 19.76%, underscoring the effectivity and profitability of tech firms throughout the U.S. company panorama.

The highest 4 sectors—Know-how, Power, Healthcare, and Financials—stand out as main contributors, collectively accounting for 75 firms and producing a considerable $779 billion in revenue, representing 72% of the overall revenue throughout all sectors in the US.

Healthcare, with the best whole income of $2.5 trillion, additional solidifies its prominence.

On the opposite finish of the spectrum, the Media, Wholesaler, and Retail sectors exhibit the least profitability, with revenue margins of solely 0.76%, 1.53%, and a pair of.60%, respectively, highlighting the modern-day challenges confronted by these sectors within the specified fiscal 12 months.

Methodology

Our complete evaluation delved into the profitability of firms listed within the Fortune 500, a globally acknowledged listing comprising firms with the best income. Our goal was to make clear essentially the most worthwhile firms and sectors worldwide, with a selected emphasis on how U.S. firms fare compared to their worldwide counterparts.

Strategy to Evaluation

- Knowledge Supply: We sourced our information from the Fortune 500 listing, making certain that we based mostly our insights on a dependable and revered international enterprise rating.

- Profitability Focus: The first focus of our evaluation was profitability. We evaluated not simply the revenues however extra importantly, the earnings of those firms to gauge their monetary well being and efficiency.

- Sector-Sensible Evaluation: We categorized firms based mostly on their operational sectors, permitting us to establish which industries are main by way of profitability and that are dealing with challenges.

- U.S. vs. World Comparability: A big a part of our evaluation concerned evaluating the efficiency of U.S.-based firms towards these from different components of the world. This comparability offered a broader understanding of the worldwide enterprise panorama.

- Interpretation of Knowledge: By reorganizing and scrutinizing the info from a number of views, we aimed to extract precious insights into the monetary well being and market positioning of those main entities.

The methodology employed on this evaluation enabled us to realize a nuanced understanding of the monetary dynamics at play throughout the Fortune 500 firms. It highlighted the sectors and areas which are main in profitability, offering a transparent image of the present state of worldwide enterprise and financial traits.

#Worthwhile #Firms #U.S #Relaxation #World #Develop #Convert